Disasters big and small bring out the conspiracy theorists. While overshadowed by the JFK assassination and 9/11, the sinking of the Titanic has been a favorite of the tinfoil-hat crowd, and has been resurrected with the destruction (implosion) of the submersible Titan last week. It is therefore worthwhile to review the realities.

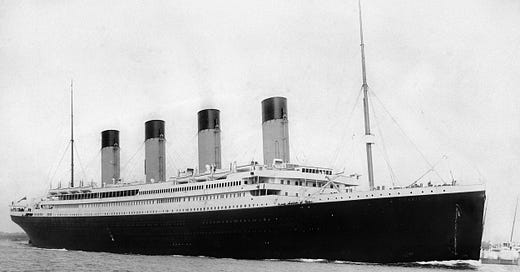

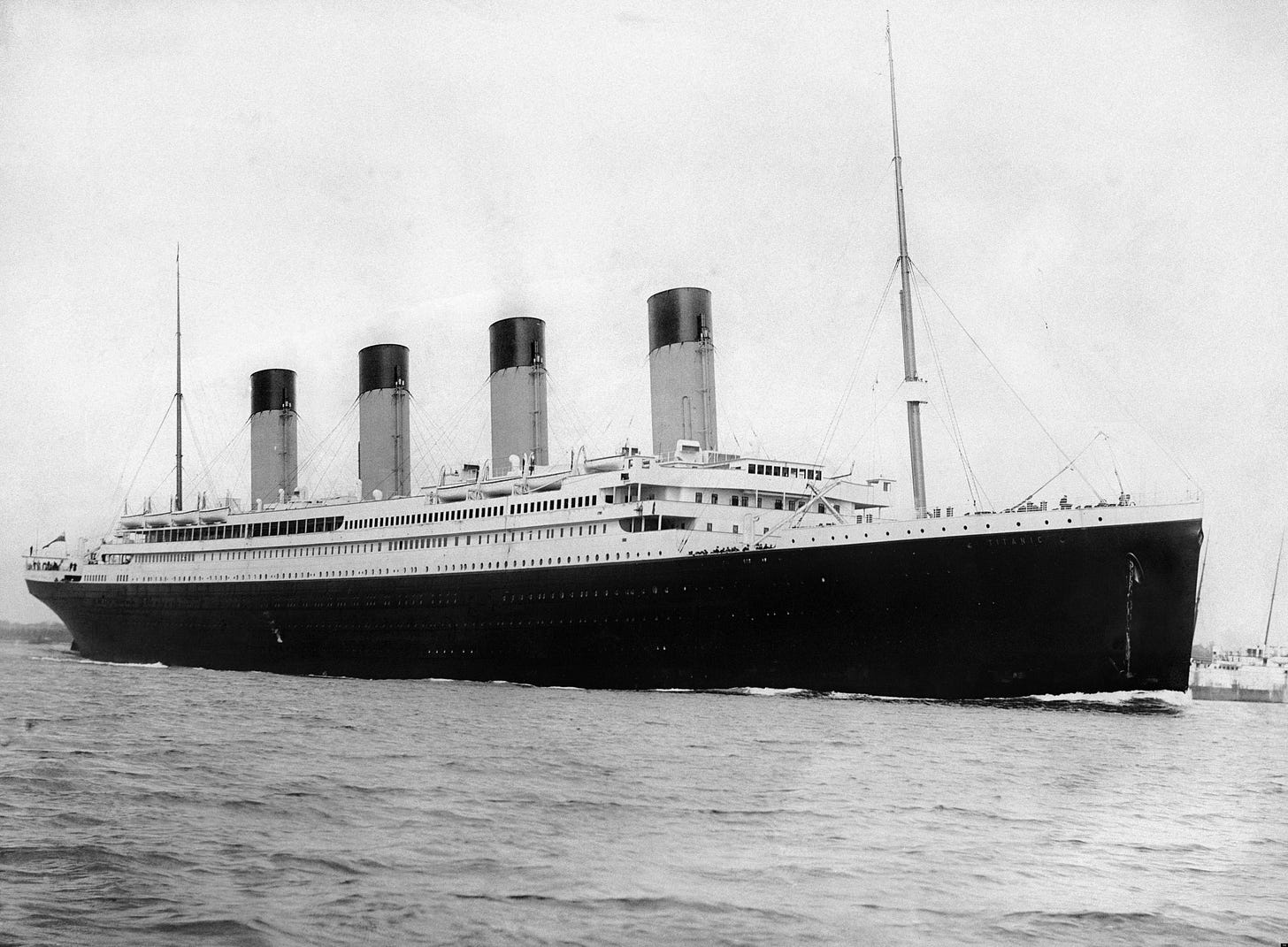

First, the Titanic was indeed a monster of a ship: 882 feet long, displacing 66,000 tons (or more than most warships of the day), held together with 8 million rivets and propelled by 29 boilers of 18-25 feet in diameter each, delivering 55,000 horsepower, the ship was designed to be unsinkable. It had a double bottom and state-of-the-art compartmentalized construction.

On Sunday, April 14, 1912, the ship struck either an iceberg or, as some recent evidence suggests, pack ice. Either way, it hit ice and did not “explode.” Consistent with this, recent debris recovery and analysis shows that the steel not only hit something outside the hull, but that it shattered in a long gash because it had not been made with super-cold temperatures in mind and had become brittle. The long slash down the side made the compartmentalization irrelevant.

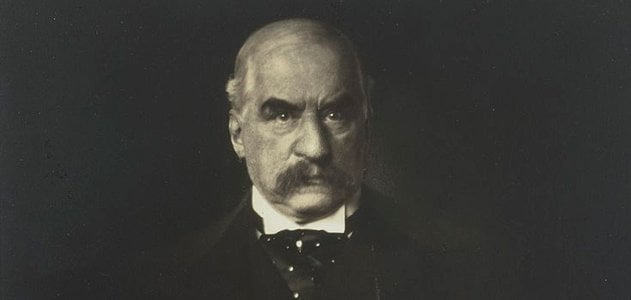

Conspiracy theorists claim that because several extremely wealthy men—-Isador Straus, Benjamin Guggenheim, and John Jacob Astor IV were aboard—-and because (supposedly) they opposed the creation in the United States of the Federal Reserve System, the uber-powerful banker J. P. Morgan destroyed the ship and got his Fed.

The problems with these coocoo theory are manifold. First, none of the men cited above were opposed to the Fed. Two had expressed no opinion (Astor and Guggenheim) while Straus spoke in favor of it. Morgan, who had reserved a seat and a special cabin with lavish accommodations, changed his plans at the last minute to stay in France. Several historians have documented his legitimate reasons for staying.

But let’s just sink this conspiracy about the Fed (pardon the pun) once and for all. It mostly derives from a book called The Creature From Jekyll Island by Edward Griffen in which a small cabal of senators and bankers whip up the Fed overnight to control America’s money supply.

Nothing could be further from the truth, and anyone trained in economic or financial history knows better. My training, as it turns out, is precisely in banking and financial history. I have written numerous books on banking, including my dissertation published as Banking in the American South from the Age of Jackson to Reconstruction. I also went on to write Banking in the American West with Lynne Doti, and have published articles on American banking in the prestigious Journal of Economic History, Journal of Southern History, and Business History Review. In addition, I edited two volumes of The Encyclopedia of American Business History on Banking and Finance, 1900-1913. So I know just a tad of which I write.

Nevertheless, the very best account of the history of the Fed is that of Princeton economist Eugene White, called Regulation and Reform of American Banking. Far from being whipped up on Jekyll Island, the Fed was the result of a decades long process undertaken after the Civil War by the American Bankers Association (1875) which was responding to calls from small, “country” banks. There were three problems in the system: first, after the Civil War, only the National Banks could print currency, backed by U.S. bonds. State banks still existed, and by 1900 outnumbered the National Banks, but couldn’t print money. Thus, there was perpetually a shortage of cash, especially in the destitute South and in the West. “No money in Kansas” was the call of one entrepreneur.

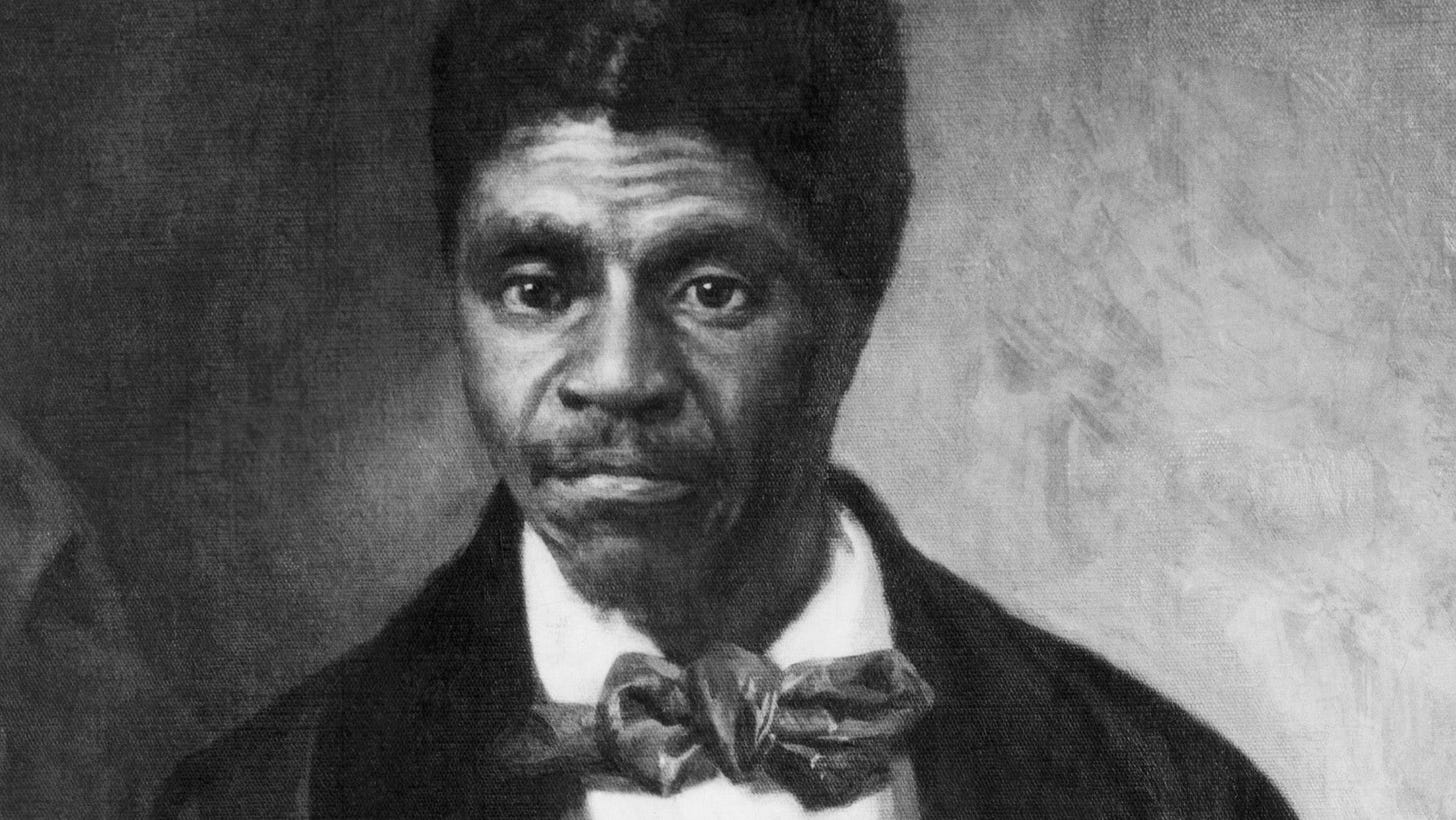

Second, panics such as the Panic of 1819, 1837, 1857, and 1873 saw many banks fail, often for reasons totally unrelated to the overall economy or to their specific business. For example, in the Panic of 1857, Prof. Charles Calomiris of Columbia and I showed that the Panic was caused by the Dred Scott decision. That’s right! The U.S. Supreme Court triggered a panic by opening the entire western territories up to slavery and foisting on the country the possibility of “Bleeding Kansas,” with small armies of free-soilers and pro-slavers killing each other and blowing things up. Including railroads! That caused the bonds of east-west railroads to collapse (but not north-south running routes), thus perpetuating eastern bank collapses of banks holding those particular bonds.

So bankers needed to have a “lender of last resort,” an entity that in such circumstances could prohibit a large bank failure that would in turn trigger a system wide panic.

Third, the local bankers feared the power of New York banks. Yes, they feared New York Jewish banks (even though some of the largest, such as J. P. Morgan, were “Protestant” owned banks).

The20-year process whereby the American Bankers Association, representing these small banks, put together reforms resulted in the structure of the Fed being presented to Congress in 1912. Once again, while it doesn’t fit the conspiracy narrative, whatever happened at Jekyll Island merely finalized and rubber-stamped a long-developed organization designed by and for America’s smaller banks! The story of how New York nevertheless emerged with inordinate power over the other 11 banks in the system is a separate story, but it wasn’t designed that way on paper.

Thus, any notion that three people were deliberately killed because they “might” oppose this system—-which was already finalized and already awaiting the finishing touches—-is absurd, even if the men had opposed it. Which they didn’t.

To slog through 30 years of ABA records, correspondence with the local banks, and the minutia of financial organization is boring and certainly not as titillating as a planned sea disaster that enabled a corrupt cabal to gain the financial upper hand over a country. But it happens to be right.

Larry Schweikart

Rock drummer, Film maker, NYTimes #1 bestselling author

Please help us make Patriot’s History of the United States into a fantastic mini-series. Watch the trailer and “Buy Larry a Coffee” if you love it.

http://buymeacoffee.com/larrys